You’ve just won a new contract with a distributor. Congratulations! But a few weeks later, during your field visit, reality hits you: your products are stuck at the bottom of the shelf, virtually invisible, while the competition occupies the strategic eye-level positions. The result? Sales below expectations, and a customer beginning to question the relevance of your offer.

Many merchandisers and area managers are familiar with this situation. The difference between a successful product and one that has stagnated is sometimes just a few centimetres of shelf space. The shelf space is more than just a figure: it’s a decisive indicator that directly influences your sales performance.

What is shelf space? Definition and importance

Linear share definition

Let’s start by laying the foundations. The share of shelf space represents the physical space occupied by a brand or product on the entire shelf dedicated to its category. In concrete terms, if you sell cereals and your brand occupies 2 meters of a 10-meter shelf, your shelf share is 20%.

But there are two ways of measuring this space. The floor space only takes into account the horizontal length of your layout. More precise, the developed linear also takes into account the height and number of levels occupied. If your products are displayed on three shelves of 50 cm each, your developed shelf space will be 1.50 meters, even if your floor space is only 50 cm.

Another concept to master: facing facing. This is the number of visible faces of your products side by side on the shelf. Three bottles lined up abreast = three facings. The more facings you have, the more your product attracts the eye of consumers strolling down the aisle.

Why is shelf space a strategic indicator?

You may be wondering why you spend so much energy on those few centimetres on the shelf? The answer is simple: your share of shelf space directly influences your sales. A visible product sells, a hidden product stagnates. It’s as simple as that.

Behavioral studies confirm it: faced with a well-stocked shelf, the consumer makes a purchasing decision in just a few seconds. Products positioned at eye level naturally capture their attention. Those at the top or bottom of the shelf? They often go unnoticed, unless the customer is actively looking for them. Your share of shelf space therefore determines your chances of entering the consumer’s field of vision at the decisive moment.

Beyond visibility, this indicator reflects your power relationship with retailers. A significant share of shelf space indicates that you have been able to convince the retailer of the relevance of your offer. It also reflects your negotiating skills and past sales performance. Distributors don’t offer space for charity: they invest in brands that generate sales revenue and margin.

Last but not least, your share of shelf space is a measure of your competitiveness. How do you stack up against your direct competitors? Are you the visible leader in your category, or a challenger yet to prove itself? This objective data helps you assess your real market position.

How do you calculate your linear share?

The basic calculation formula

Now let’s get down to business. Calculating your linear share is simpler than it looks. Here’s the basic formula:

(Length of shelf space occupied by your brand / Total length of shelf space in the category) × 100

Let’s take a concrete example. You represent a brand of yoghurts. The dairy products section of this supermarket is 12 meters long. Your brand occupies 2.40 meters. Your share of shelf space is therefore (2.40 / 12) × 100 = 20%.

For a more precise calculation, use the expanded shelf space. Imagine that the shelf has 4 shelves. The total developed shelf space is therefore 12 × 4 = 48 meters. If your brand occupies 2.40 meters on two shelves, your developed shelf space is 2.40 × 2 = 4.80 meters. Your share of developed shelf space is (4.80 / 48) × 100 = 10%. This nuance is important, as it more accurately reflects the actual space you occupy.

Example of calculation for 3 brands

Brand |

Ground line |

Number of shelves |

Developed linear |

Share of developed shelf space |

|---|---|---|---|---|

| Mark A (leader) | 4,80 m | 4 | 19,20 m | 40% |

| Your brand | 2,40 m | 2 | 4,80 m | 10% |

| Brand C (challenger) | 3,60 m | 3 | 10,80 m | 22,5% |

| Total category | 12 m | 4 levels | 48 m | 100% |

Field measurement tools

In the field, how do you go about it? The simplest method is to use a good old-fashioned tape measure. Measure the length occupied by your products, then the total length of the shelf. Also note the number of shelves and the presence of any special operations (gondola heads, promotional islands).

Today, mobile applications let you measure distances simply by pointing your smartphone. Handy when you’re making one visit after another and every minute counts. And don’t forget to systematically take photos of your sites: these images will be invaluable visual evidence in your dealings with retailers and customers alike.

Professional tools go further. The planograms (or merchandising plans) formalize the ideal layout of each product on the shelf. These diagrams detail the exact location, number of facings and height of each product. Some merchandising software even allows you to create digital planograms and compare them with the reality on the ground.

Whatever your method, it’s essential to take regular readings. A point of sale can change its layout from one day to the next following a promotion, a restocking or a competing negotiation. Only rigorous monitoring will enable you to react quickly.

Strategies for increasing shelf space

Preparing for negotiations with distributors

Want to gain a few centimetres over the competition? Negotiation doesn’t just happen. It requires methodical preparation, backed up by figures. Before you meet with the buyer or department manager, you need to gather all the data you can to demonstrate the relevance of your request.

Start by analyzing your sales performance. What’s your product turnover? How much sales revenue per linear meter do you generate compared to the competition? What is your margin rate for the distributor? These objective indicators form the core of your sales pitch. Buyers don’t offer extra space out of sympathy: they invest in the brands that maximize their profitability.

Then study the competition. Who occupies how much space? What are their strengths and weaknesses? Identify opportunities: a brand in decline whose shelf space you could take over, a competitor who doesn’t respect their promotional commitments, an under-exploited area of the shelf where you could position yourself.

Build your sales pitch around three pillars: innovation, marketing and support. Present your new products, your current or future advertising campaigns, your ability to energize the category. Offer concrete benefits: in-store events, attractive POS, team training to promote your products, generous promotional offers.

- 8 essential points before a lineal negotiation :

- Current rotation of your products in this outlet

- Sales per linear metre vs. competition

- Distributor margin rate on your references

- National and local market share

- Product innovations planned over the next 6 months

- Marketing budget and media plan

- Proposed promotional agreements

- POS and field events planned

Optimize in-store product presentation

Gaining shelf space is one thing, but exploiting it effectively is another. The way you present your products has a direct impact on their appeal, and therefore on your sales. The merchandising isn’t just about taking up space: it’s about creating a visual impact that grabs the consumer’s attention.

The facing plays a crucial role. A minimum of three facings is generally required for a product to be noticed. Anything less is likely to go unnoticed in the crowd. Distribute your facings judiciously between your different references: give priority to your best-sellers and your new products, which deserve to be highlighted.

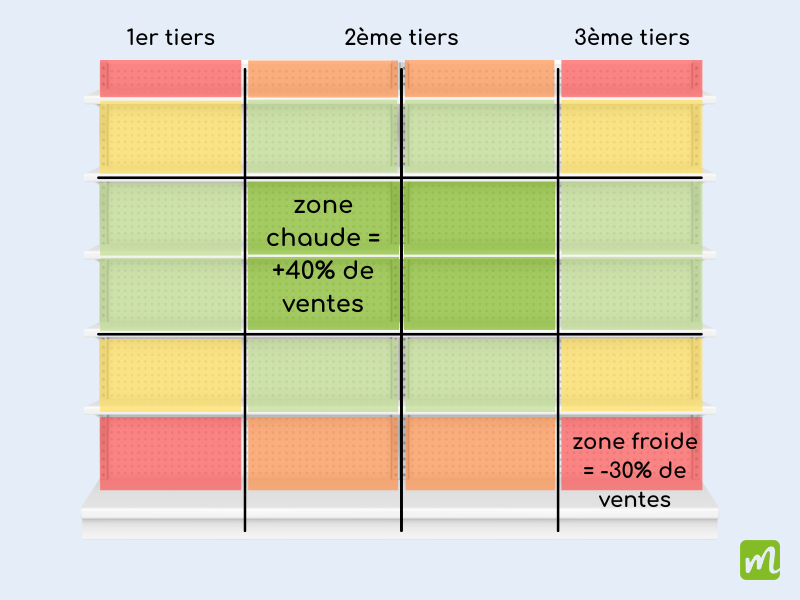

The vertical positioning is just as strategic. The area between 1.20 m and 1.60 m high is the most visible: it’s where the eye naturally falls. Place your flagship products there. The upper levels are suitable for bulky products or references that customers already know and are actively looking for. The lower levels are generally used for first-price products or family formats.

The POS (point-of-sale advertising) reinforces your presence. Shelf-stoppers, promotional banners, attractive price stickers: these elements guide the consumer’s eye towards your products. Be careful, however, not to overload your POS: excessive POS creates confusion and dilutes your message.

Negotiating strategic locations

Beyond quantity, the quality of your location makes all the difference. Not all shelf space is created equal. Some areas of the store and shelf naturally generate more sales than others: these are the premium locations that you should aim for.

Visit gondola headslocated at the end of the aisle, offer maximum visibility. They are often reserved for promotional operations, but if you manage to negotiate one for a product launch, the impact will be considerable. The central islands and high-traffic areas (store entrances, near checkouts) also offer great potential.

Inside the shelf itself, position yourself on the hot spots At the entrance to the aisle, where the eye is first attracted, at eye level, and in front of natural traffic flows. As far as possible, avoid cold areas at the end of the aisle or in blind spots.

For new product launchesnegotiate advantageous temporary locations. Offer a three-month trial in a premium location. If sales are good, you’ll be able to argue for a permanent location. If not, at least you’ll have given your innovation a real chance.

Tracking shelf space: a daily challenge for field sales representatives

Why regularly track your linear share?

You’ve negotiated, you’ve gained shelf space. Victory! But the story doesn’t end there. The field is a fast-moving environment where nothing is ever taken for granted. A location can change from one day to the next, and if you don’t regularly monitor your points of sale, you risk losing ground without even realizing it.

Field monitoring allows you to detect loss of space before they become critical. Has a competitor launched a promotional offensive and nibbled 20 cm off your shelf space? You need to know quickly to react. The earlier you identify these changes, the more effectively you can intervene with the distributor.

You can also identify breaches of commercial agreements. Had you negotiated a three-level layout? In the field, you only find your products on two shelves. This kind of discrepancy between theory and reality is not uncommon, and is often due to errors of execution or to local decisions taken without consultation. Your regular presence ensures that commitments made are respected.

Monitoring also helps toanticipate break-ups. A product that sells well will have empty facings more often than not. If you notice recurrent out-of-stocks, this is a positive sign (high demand), but also a problem to be solved (loss of sales). You can then work with the point of sale to improve restocking or justify an increase in shelf space.

Finally, your regular visits enable you to measure the effectiveness of your merchandising actions. Has the new POS really boosted sales? Has the change of layout paid off? Only regular analysis in the field will give you the answers.

The challenges of field follow-up for sales forces

Keeping track of your linear share in the field is theoretically obvious. In practice, it’s a different story. Merchandisers, independent sales representatives and outsourced sales forces face a number of challenges that complicate this essential task.

- First obstacle: the multiple points of sale. You manage a portfolio of 80, 100, sometimes 150 stores spread over a wide area. How can you ensure regular, exhaustive monitoring of all these points of sale when your weeks are only five days long, and travel takes up a lot of your time?

- Second difficulty: the variability of locations. Even within the same brand, each store has its own specific characteristics. Shelf layouts differ, available floor space varies, local merchandising choices create disparities. As a result, you have to adapt your analysis to each visit, which requires time and attention.

- Third constraint: the limited in-store time. You have to check the layout, take measurements, identify problems (out-of-stocks, missing POS, poorly positioned products), intervene with the floor manager if necessary, and move on to the next point of sale. All this in a maximum of 20 to 30 minutes per store, if you want to keep to your schedule.

- Fourth challenge: data data centralization and analysis. You’ve done your surveys, taken your photos, recorded your observations. But what do you do with them? How do you consolidate this information to get an overall picture? How do you identify trends, problem areas and opportunities? Without an organized system, you accumulate data that you never really exploit.

- Fifth problem: turning findings into action. You have identified that a store is not complying with the negotiated agreement. What happens next? Who do you contact? When do you plan to return to verify the correction? How do you ensure that the problem doesn’t recur? Without methods and tools, your observations often go unheeded.

A merchandising salesperson visits an average of 15 to 25 points of sale per week, with only 20 to 30 minutes per store to check the layout, availability and condition of products. Over the course of a month, this represents over 60 visits and hundreds of items of data to be collected and analyzed.

Best practices and mistakes to avoid

Common mistakes when managing a linear share

Even experienced salespeople sometimes make mistakes that compromise their effectiveness. Identifying these common pitfalls will help you avoid them and maximize the impact of your field actions.

Mistake number one is to to focus solely on quantity. It’s true that gaining centimetres is important, but not at the expense of the quality of the location. It’s better to have 1 meter at eye level than 2 meters at ground level in a cold area of the aisle. Always negotiate with volume and positioning in mind.

Many salespeople neglect post-trade follow-up. You’ve reached a favorable agreement? Great! But if you don’t regularly check that this agreement is being respected in the field, you run the risk of finding six months later that the actual implementation has never corresponded to what was agreed. Follow-up is just as important as the initial negotiation.

Another common mistake: not training store teams. You may have negotiated a perfect layout, but if the staff who put the products on the shelves don’t understand your planogram or haven’t been made aware of its importance, they’ll do things their own way. Take the time to explain your expectations to department managers and stocking teams. This human relationship often makes all the difference.

Finally, too many salespeople underestimate the importance of relationships with department managers. It is they who, on a day-to-day basis, make the actual decisions about product placement. A good relationship with them is sometimes worth more than a centrally-negotiated national agreement. Respect their expertise, listen to their constraints, and offer them solutions rather than demands. This collaborative approach generates far superior results in the long term.

Best practices of top field sales representatives

Conversely, the most successful salespeople share common habits that explain their success. Take inspiration from these best practices to optimize your own approach.

Rule number one: establish a regular visiting schedule and stick to it rigorously. The best salespeople don’t visit their outlets at random or when they have time. They plan their rounds several weeks in advance, defining a frequency adapted to each store according to its strategic importance. This regularity creates automatisms and ensures that no point of sale is neglected.

Second habit : systematically take photographs of installations. For every visit, a photo of the shelf. This discipline creates an incomparable visual history. You can compare changes over time, identify trends and objectively prove problems to distributors. These photos become your best arguments in negotiations.

Third practice : building a relationship of trust with store teams. Successful salespeople don’t just take figures and leave. They take the time to talk with store managers, to understand their constraints, to offer advice. This proximity generates natural cooperation: store teams become your allies, alerting you when a problem arises and promoting your products because they like you.

Fourth reflex : share best practices between outlets. Have you tested a particularly effective layout in a store? Found a clever solution to a recurring merchandising problem? The best sales people capitalize on these discoveries and systematically replicate them in all their outlets. In this way, they create standards of excellence that they gradually roll out throughout their territory.

Fifth winning habit: measure and celebrate success. Every shelf space gain, every sales improvement following a merchandising action, every new point of sale conquered: these victories deserve to be recognized and shared. Successful salespeople document their successes, communicate them to their superiors, use them to motivate their teams and reinforce their credibility with retailers.